Over 70 Years of Estate Planning Experience

Serving Annapolis, Pasadena, Frederick, and Stevensville

For over 70 years, the experienced Maryland Estate Planning Attorneys at Frame & Frame have been serving the legal needs of our community. Estate planning is a very personal matter. It not only affects you and your loved ones, but perhaps your legacy and future generations. For these reasons, the Maryland estate planning lawyers at Frame & Frame can help you carefully consider the importance of having a will or estate plan that is structured for your specific needs.

Get Started Today!

Estate planning does not have to be an expensive or complicated process. For about the cost of a weekend getaway, most families can have the peace of mind and assurance that their needs will be handled, in the event of a crisis. Get started by downloading one of our free legal guides or scheduling a consultation.

Estate planning does not have to be an expensive or complicated process. For about the cost of a weekend getaway, most families can have the peace of mind and assurance that their needs will be handled, in the event of a crisis. Get started by downloading one of our free legal guides or scheduling a consultation.

Do You Need a Will or Trust?

A will or trust is important for everyone – regardless of age, marital status, financial status, in good or poor health with the legal documents they need to protect themselves and their loved ones, because accidents and unexpected illnesses can happen to anyone.

Many people do not understand the difference between a Will and a Trust, or unknowingly, may think that one costs substantially more than another. The most common misconception is that a trust is only for wealth families. However, there are many instances where a trust can better serve your needs, while you are living, and after you pass. The Maryland estate planning attorneys at Frame & Frame discuss your specific situation and make recommendations on which tools would best serve your unique needs.

Although a will can serve some needs, the estate planning attorneys at Frame & Frame Attorneys at Law are able to help you consider a wider variety of possibilities that may arise and ensure your wishes are carried out, in the event of incapacitation or death. Our attorneys will help you understand the difference between a will and a trust and determine which legal instrument will best serve your needs. We can also help you avoid some of the most common estate planning mistakes.

Top 10 Questions About Estate Planning

Your attorney will serve as your legal guide and trusted advisor to answer all of your questions. In addition, we have a list of the Top 10 questions about estate planning, along with an entire video library you can review, at your leisure, to get answers to your estate planning questions. View the video to get answers to the most common#estate-planning-faqs questions about estate planning.

A Wide Array of Estate Planning Services

At the law firm of Frame & Frame, our dedicated Maryland Estate Planning Attorney advocates regularly assist clients in Maryland with a wide variety of estate planning needs. As a matter of fact, our firm received the “Maryland Attorney Advocate of the Year” award for these services. We assist with a wide array of estate planning services as you can see and we offer our free legal guide to Estate Planning Essentials as a great way to educate yourself and begin the conversations with loved ones, before executing a will or estate plan.

Easy Estate Planning Process

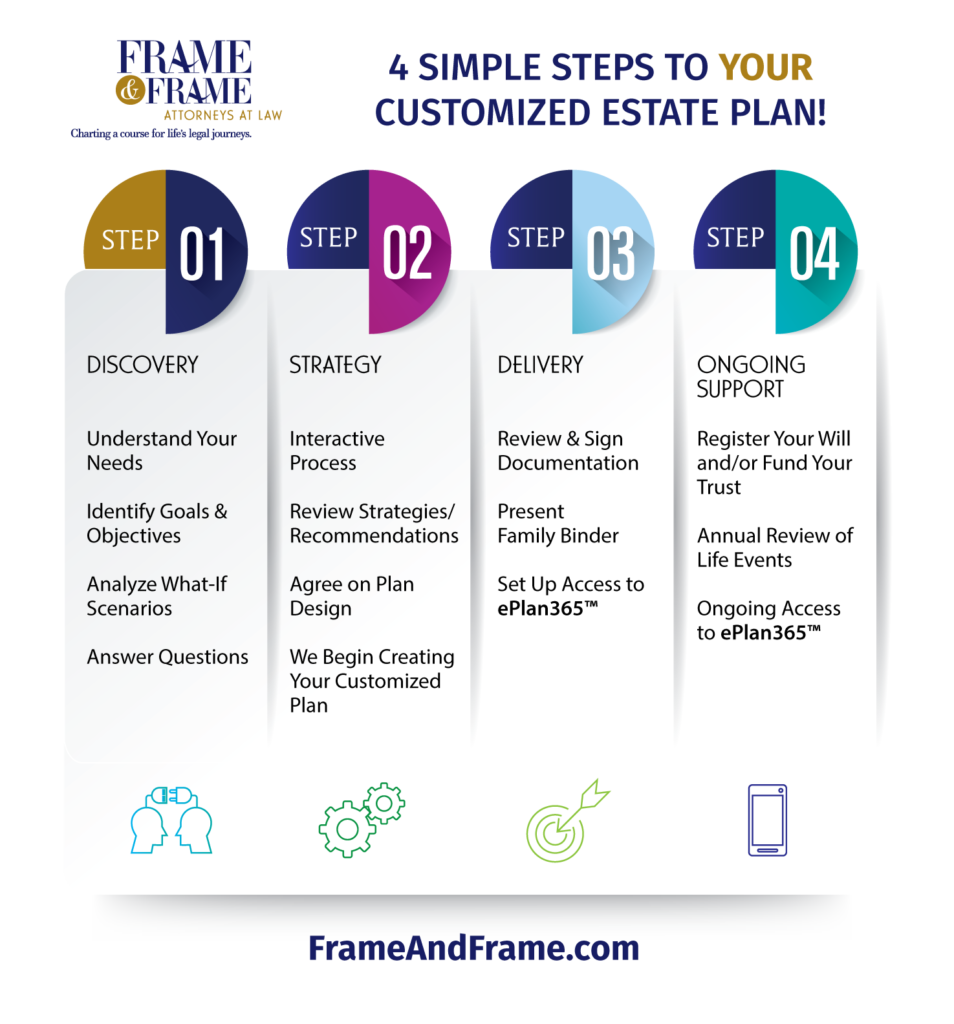

Since we have been providing estate planning services for over 70 years, we know how to make estate planning easy for you and your family with our customized Easy Estate Planning 4-Step Process. In addition, we also offer an easy way to keep your family informed with our proprietary ePlan365 tool which utilizes the latest secure HIPAA-compliant technology to provide your family with the documents and resources they need, in any crisis.

Basic Estate Planning

A very basic estate plan provides important legal documents for your family, in the event of your incapacitation, sudden illness, or even death. These documents allow you to control the distribution of your assets, who will administer your estate, and who will care for your children and their inheritance. You place your assets, your children, and your family at risk without proper planning. The Maryland Estate Planning Attorneys at Frame & Frame help you create a plan that will protect and provide for your loved ones.

It’s important to have, at the very least, the basic estate planning documents to protect you, and to help your family and heirs manage your affairs in the event of your illness, hospitalization, incapacitation, or death. Our basic estate planning services provide you:

- Last Will & Testament or Trust

- Healthcare Power of Attorney

- Financial Power of Attorney

- Advanced Directive/Living Will

In Maryland, there can be serious consequences if you become incapacitated or die without a will. Here are some examples:

- If you are incapacitated, your loved ones will require certain documentation to act on your behalf for financial matters,

- If medical decisions need to be made, Health Care Powers of Attorney ensures that your wishes are carried out and to help give your loved ones some direction when making important medical decisions to take the weight off their shoulders.

- After your death, the probate process, taxes, and other factors may absorb much of the inheritance you hoped to pass on to loved ones.

Your Estate Planning Consultation

During your initial estate planning consultation, you will personally meet with one of our experienced lawyers who focus on estate planning, to discuss the best options for you and your unique situation. This personalized approach provides you valuable legal guidance and allows your family to have a trusted advisor, during a crisis. During the estate planning process, we can provide guidance on any of the following:

- Drafting a will

- Developing a healthcare power of attorney

- Developing a durable (financial) power of attorney

- Creating a living will

- Asset protection

- Medicaid planning

- Creating revocable living trusts

- Creating irrevocable trusts

- Creating special needs trusts

- Estate administration

- Probate

Special Circumstances for Estate Planning

There are also specific circumstances, based on your unique situation, which make estate planning even more important. In these cases, your lawyer can help you determine which legal instrument is best for your unique situation. Our Free Guide to Estate Planning discusses the special circumstances that may need to be considered for:

There are also specific circumstances, based on your unique situation, which make estate planning even more important. In these cases, your lawyer can help you determine which legal instrument is best for your unique situation. Our Free Guide to Estate Planning discusses the special circumstances that may need to be considered for:

- Families with Children

- Blended Families

- Families with Special Needs

- Families with Substantial Wealth

- Single People & Unmarried Families

- LGBTQ Families

Estate Planning, Probate, and Maryland Taxes

It is particularly important for Maryland residents to understand Probate and its impact on estate planning since Maryland has both an estate tax and an inheritance tax. Why does this matter? In brief, many other states simply tax based on either system as opposed to both. For this reason, Maryland residents must consider the probate process, their exposure (and that of his/her relatives) to taxation through estate and inheritance, and any legal strategies to reduce exposure.

It is particularly important for Maryland residents to understand Probate and its impact on estate planning since Maryland has both an estate tax and an inheritance tax. Why does this matter? In brief, many other states simply tax based on either system as opposed to both. For this reason, Maryland residents must consider the probate process, their exposure (and that of his/her relatives) to taxation through estate and inheritance, and any legal strategies to reduce exposure.

If you are planning to leave assets to your family members and to organizations that you support, you may also need help learning about ways to minimize liabilities under these two systems of taxation. The Maryland estate planning attorneys at Frame & Frame can evaluate your situation to assist in creating strategies that will help. In addition, if you lose a loved one, our probate attorneys can help you navigate the complex probate process.

Long Term Care & Medicaid Planning

Long-term care planning or Medicaid planning is not the same as estate planning. Does your estate plan protect your assets from the substantial costs of long-term care? Is your legacy and children’s inheritance at risk? Will your spouse be properly cared for, or will your assets be subject to government restrictions? Your estate plan should include a strategy for long-term care and only an experienced elder law attorney can assist you with these considerations. Download the free legal guide to Long Term Care planning.

Long-term care planning or Medicaid planning is not the same as estate planning. Does your estate plan protect your assets from the substantial costs of long-term care? Is your legacy and children’s inheritance at risk? Will your spouse be properly cared for, or will your assets be subject to government restrictions? Your estate plan should include a strategy for long-term care and only an experienced elder law attorney can assist you with these considerations. Download the free legal guide to Long Term Care planning.

Unfortunately, many people think that if they’ve done an estate plan, they have covered long-term care or Medicaid planning issues. Nothing could be further from the truth! Long-term care or Medicaid planning is not estate planning and only an experienced Elder Law attorney can properly guide you through the pros/cons of why you may or may not need Medicaid planning, in addition to an estate plan. The attorneys at Frame & Frame are also experienced in Elder Law, so we can advise you simultaneously on the important considerations that may impact your estate plan and long term care strategies.

Trusts and Other Estate Planning Matters

There are many types of trusts that can be created to serve your unique needs. Trusts are comprehensive, may provide tax benefits, help you avoid the probate process and are not just for wealthy families. In fact, many younger families benefit from a trust, much more so than a simple will. With minors, in particular, the needs of your children must be considered during the estate planning process to determine if a will or trust would better serve your family’s needs.

In some cases, individuals have children with special needs for whom they will have to set up a particular type of trust. In other situations, a Maryland resident may want to establish a trust to help children and other family members to pay for college or other necessary educational expenses.

Given that there are many different kinds of trusts, it is important to seek advice from an estate planning lawyer. You will also want to ensure that if you establish a trust, it is funded and revisited, as life changes over the years. Our Maryland estate planning attorneys can help you evaluate the best options for your situation and take the weight off your shoulders.

ePlan365™ puts the Plan In Your Hand™

If an unexpected crisis or tragedy occurs, your loved ones will be focused on solving the challenges, making decisions, and dealing with the family’s emotions. There will likely be many questions and decisions to be made, depending upon the circumstances. The biggest question of all… “What’s the plan?”

At Frame & Frame, we’ve helped people, for over 70 years, face the challenges and questions that arise. We have seen families struggle to locate important health care or legal documents, argue over the intentions or wishes of a loved one, and try to access financial accounts to continue to pay mortgages and other bills. That is why we have invested in technology that makes all of this easier on you and your family.

Today, we are one of the only estate planning firms that offer our clients a proprietary platform so that every decision, document, and resource is available to your loved ones instantly. You can pre-determine when and how the documents are accessible, based on the crisis, events, or circumstances. Our ePlan365™ puts the Plan in Your Hand™. Learn more about this unique service we provide exclusively to our clients.

Get Started Today!

Estate planning does not have to be an expensive or complicated process. For about the cost of a weekend getaway, most families can have peace of mind and assurance that their needs will be handled, according to their wishes. In addition, our Maryland estate planning attorneys serve as a legal guide to help your family navigate the legal, healthcare, and probate issues that may surround any crisis. Get started by downloading free legal guides or scheduling a consultation.

Estate Planning FAQ’s

Common misconceptions lead many Americans to avoid estate planning. Some of these misconceptions include:

• They believe that working with an estate planner is expensive;

• They think that a will is adequate to meet the needs of them and their family;

• They think that their family members will behave amicably and will sort out

the estate by themselves without legal guidance; and

• They believe that they do not have enough assets to make estate planning worthwhile.

These misconceptions often leave family members with difficult and sometimes,

controversial decisions. Estate planning allows you to consider these decisions, long before an illness or injury occurs, so that there is clear direction for your family, and your wishes are carried out, exactly as you intended. More importantly, estate planning ensures who will care for any younger children and that they will have access to whatever financial resources are available. These are just a few

reasons estate planning is important for young and old alike.

- You determine how your estate is distributed:

A Will is a legally binding document that allows you to direct who receives your assets upon your death. You may leave your assets and property, both real and personal, to anyone you choose, subject to certain statutory rights of a surviving spouse. Without a Will, the law determines how your assets are distributed. For example, when a person dies without a Will and has no spouse and no minor children, their estate is divided equally between the deceased person’s adult children and his/her surviving parents. This may not be how you want your estate to be distributed among your heirs. - You decide who will handle your estate:

Probating and settling an estate can be a very complex task. You want someone who is honest, responsible and well organized to handle your estate matters. In your Will, you name a Personal Representative, or Executor, to probate your estate and to ensure that your assets are distributed according to your wishes as stated in your Will. Your Personal Representative is responsible for opening the estate, filing an inventory of the estate assets, paying debts or claims of the estate, managing or selling real property in the estate, filing tax returns on behalf of the estate, and making the final distributions from the estate, just to name a few. If you do not have a Will, the Court will appoint a person to handle your estate. That person may not be the person that you would have chosen and could, in fact, be one of your creditors. - You decide who will care for your minor children:

If you have minor children under the age of eighteen (18), you will want to name a guardian and trustee or custodian for your children. The guardian is the person with whom your child will live and who will care for your child on a day to day basis. The trustee or custodian is the person who will hold and manage the child’s inheritance until such time as the child reaches an appropriate age, determined by you and stated in your Will. The guardian and trustee or custodian may be the same person but does not have to be. In certain instances, the person who will best care for your child may not be the best person to manage their money. - You can set up a trust for minor children or special needs children:

If you have children under the age of 18 or a special needs child, you may want to consider including a trust. A special needs child who is receiving governmental benefits may lose those benefits if they receive an inheritance directly from your estate. Additionally, a minor child would receive their share of the estate upon reaching the age of 18 (the age of majority in Maryland). A young adult may not be responsible for handling and managing large sums of money and you may want to spread the distribution out over several years or throughout the child’s lifetime. You can appoint someone, called a Trustee, who will hold and manage the child’s money for them. You can instruct that the funds be used strictly for certain purposes, such as college or the purchase of a house. - You can disinherit family members:

Unfortunately, there are instances when you do not want certain heirs to inherit your property or funds. If an heir is subject to judgments, has filed for bankruptcy or is receiving government benefits, you may choose not to include that person in your will. There may be an estranged child that you do not want to receive part of your estate. In your Will, you have the right to leave your estate to whomever you choose and might include provisions to avoid having your Will challenged by an heir. - You can avoid arguments and hostility among family members:

When you have a Will, you make your intentions clear. You state who you want to handle your estate, how the funds are to be distributed and when and on what conditions those distributions take place. Without a Will, there can be arguments among family members as to who gets what and who should be responsible for opening and handling the estate. A Will can avoid many arguments and misunderstandings among family members by clearly stating your wishes. - To give you peace of mind:

You will have greater peace of mind knowing that your family is taken care of when you are no longer here to care for them. By having your estate plan in place, you take away some of the stress placed on your family, who will already be going through an extremely emotional and difficult time.

Everyone needs an estate plan regardless of age, marital status, economic bracket, good/poor

health because accidents can happen to anyone. Although a will can serve some needs, the

estate planning attorneys at Frame & Frame Attorneys at Law are able to help you consider a

wider variety of possibilities that may arise and ensure your wishes are carried out, in the event

of incapacitation or death.

In Maryland, there can be serious consequences, both financial and logistical, if these issues are not considered and properly addressed. Here are some examples:

- If you are incapacitated, your loved ones will require certain documentation to act on your behalf for financial matters.

- If medical decisions need to be made, Health Care Powers of Attorney ensure that your wishes are carried out.

- If you are diagnosed with a long-term illness like Alzeheimers or Parkinsons Disease, this will give your loved ones direction when making important medical decisions to take the weight off their shoulders.

- A young family may have named Godparents to care for their children, but who has the ability to sell and preserve assets to provide for your children’s long term care and life events?

- Your parents may have a will but have they considered the impact of their assets passing through probate? Have they made a plan for the exorbitant costs of long term care?

- After your death, the probate process, taxes, and other factors may absorb much of the inheritance you hoped to pass on to loved ones. Estate planning can help you minimize taxes, and ensure that certain assets are passed outside of the probate process.

These are just a few of the issues we discuss during estate planning. Everyone has a different set of circumstances, so you can see why everyone can benefit from going through the estate planning process to address these issues.

Estate planning helps to ensure that your wishes are carried out in the event of incapacitation (accident, coma, illness) and how best to protect and dispose of money and property, in the event of death. Everyone needs a basic estate plan, which includes:

- Last Will and Testament and/or Revocable Trust

- Financial Power of Attorney

- Appointment of Healthcare Agent (Healthcare Power of Attorney)

- Advanced Directives (also known as a Living Will)

Most people have several common goals that address concerns regarding what happens after death, including:

- Burial or end-of-life wishes,

- Leaving a legacy for loved ones,

- Distribution of assets,

- Avoiding the probate process,

- Limiting estate and death taxes.

Although not everyone needs a trust, a trust is a very useful estate planning tool and should be considered. Just a few of the benefits of a trust are:

- PRIVACY: A trust is private and confidential. Unlike a Will, a trust is not filed with the court. When an estate is opened, your will gets filed with the court and becomes public record. Additionally, your entire estate and assets are inventoried and reported to the court. The public has access to your estate documents, the value of the estate and how it was distributed. A trust, on the other hand, is completely private. It is not a public document and only the trustee and the beneficiaries are entitled to information about the trust.

- FLEXIBLE: A trust is a living document, especially a revocable trust. You, as the trustee, may modify and change your trust as your circumstances change. You have the right to amend or terminate a revocable trust at any time.

- CONTROL: A trust provides greater control of your assets after death. Unlike a will, which has certain limitations, you can control your assets even after death with a properly prepared trust. A trust gives you the ability to direct how your assets are used and to whom they are distributed for as long as you direct. You can put conditions on distributions and you can direct that property or money held in trust only be used in certain ways and for certain purposes.

- AVOIDS PROBATE: Having a trust avoids probate, as it is not filed with the court and, if all of your assets are held in trust, there would be no estate to probate. Nevertheless, you still need a Will to ensure that any other property held in your name is added to the trust and distributed according to the trust documents. This is commonly referred to as a “Pour Over Will.”

- IMMEDIATE ACCESS TO FUNDS: When a person dies and their assets are held in a trust, the trustee (or successor trustee if the decedent was the trustee) may make immediate distribution of the trust assets in accordance with the trust document. If assets are passing through a Will and going through probate in Maryland, the estate may not make distribution for at least six (6) months and, only then, upon approval of the court.

CAUTION: A trust is only effective if it is property funded, which means that all property must be transferred to the trust.

As part of our services, when preparing a trust we assist with the transfer of all assets to the trust to ensure that it is property funded in order to accomplish the goals and purposes of the trust.

No. A Power of Attorney is designed to help a loved one take care of certain medical and

financial decisions while living and is no longer valid after death. After a person dies, the power of attorney is no longer valid; it dies with you and can no longer be used to manage your affairs.

The Power of Attorney is designed for circumstances where you are unavailable, incompetent or otherwise incapacitated. After you pass, your Will then takes effect and determines who will manage your estate and how assets should be distributed. All assets (cars, houses, bank accounts, etc.) owned by you are subject to the probate process, which can be lengthy and expensive.

Under Maryland law, a personal representative is responsible for the following:

- Probate the Will, and any codicils, with the Register of Wills, obtaining a federal tax identification number to open an estate account and hiring the appropriate professionals to assist him/her.

- Ascertaining and appraise all assets of the estate.

- Paying the debts of the estate.

- Arranging for safekeeping of personal property.

- Managing assets, collecting life insurance proceeds and retirement distributions.

- Filing tax returns and paying the required income inheritance and/or estate taxes.

- Filing the necessary pleadings with the Register of Wills, including Petition to open the estate, Inventory and Administration Accounts.

- Distribute assets of the estate to the appropriate beneficiaries, account for all estate assets and expenses and close out the estate.

A personal representative is entitled to receive compensation, or commissions, for the work that they perform on behalf of the estate. The maximum allowable commissions in Maryland is 9% of the first $20,000.00 plus 3.6% of the assets in excess of $20,000.00. A personal representative has the right to waive commissions. If the personal representative hires an attorney to assist him/her with the handling of the estate, the attorney is paid from the allowable commissions. A personal representative is a fiduciary and has a fiduciary duty to the estate. This means he/she has an obligation to do what is best for the estate and to protect the assets for distribution to the heirs. The personal representative is prohibited from self-dealing or commingling estate assets with his personal assets. If a personal representative has breached his fiduciary duty to the estate, he can be held personally liable to the estate or the beneficiaries for any losses.

It is important that you choose a responsible and trustworthy person to act as your personal representative or executor, as improper handling of the estate assets can lead to expensive probate litigation and can destroy family relationships in the process.

- Not Updating your Plan

Our lives change daily and your will should be updated with any life change – namely marriage, divorce, new child or grandchild, death, etc. As we age, our wishes change, as do our relationships, careers, finances, health and marriages, and these changes should be reviewed on a regular basis as they relate to your estate plan.

- Failing to Take Minors or Young Adult Children Into Account

Will your 18-year-old child know what to do with a lump sum $100,000 inheritance? If, after you pass, your 12-year-old child’s other parent passes away, do you have a plan for guardianship? If your child is enrolled in college, will the funds you leave be enough to cover the rest of their tuition and living expenses? Parents and grandparents with minor or young adult children have all the more reason to update their wills regularly and work with experienced estate planners to ensure that they do not omit important aspects of their wishes.

- Failing to Provide for Asset Protection

Having a revocable living trust is a great way to ensure that the assets you leave to your loved ones avoid the probate process, avoid possible excessive taxation, and are used for your intended purposes. In addition, it is important to properly fund the living so that it can provide the most benefit to your heirs. Trusts can also provide important asset protection for beneficiaries, by protecting the monies in trust from future divorce, bankruptcy, judgments and creditors, as well as for special needs beneficiaries, to preserve their rights to receive essential government benefits.

Let’s start with the simple fact that every person should have either a Will or Trust to ensure that your wishes are carried out, your family is taken care of, and your assets and legacy are preserved. It doesn’t matter how many assets you have or how many family members you have a will can provide a lot of guidance during a time of family crisis.

A trust can be much more beneficial than a will for many circumstances. A Trust can be used to help manage your affairs while you are living. It may also help your beneficiaries avoid the probate process and can provide certain protections from taxes and creditors. It can also be used to properly assist any family member with special needs, blended families, and more. The best part is that a trust is completely private. So, it surprises many to learn that a trust is a very beneficial way to pass on assets to their loved ones, in a strategic manner.

Our families change over time. Children and grandchildren are born. People get married, divorced and even remarry. During this time, bank accounts, IRAs, and real estate are bought and sold. For all of these reasons, it is important to establish an estate plan so the family’s assets are protected during life and passed on to the heirs they choose, at death.

This is particularly true in blended families. When there are spouses, ex-spouses and children from different parents, the situation becomes complicated. When a person becomes a dependent of the family, or when someone passes away, the laws of the state come into play. Those laws may affect which family members inherit assets and which ones don’t, even when the deceased intended otherwise.

It may be hard to include or exclude children from a prior marriage, simply with a will. This is where an estate plan allows you to take time and consider exactly what you intend and execute the legal instruments to ensure your wishes are carried out. In addition to designating what happens when you pass, you can consider what happens after that. For example, it may be important to you to designate what happens when your spouse dies. Does all of the inheritance then go to her children, or will your children be able to receive their fair portion?

Life changes every day. Babies are born, people get married and divorced, new relationships are developed, old relationships may sour. We suggest using our annual planning checklist to determine if your will needs updating, each year.

If your will is not updated, your wishes may be a far cry from a document you drafted years ago. So, it’s important to update your will whenever your lifestyle, family members, relationships, real estate or other circumstances change.

Contact an Experienced Maryland Estate Planning Attorney

Meeting with an estate planning attorney can help you and your family plan for the future. Contact Frame & Frame today to learn more about how we can help with serve as your legal guide for thoughtful planning or during times of crisis.