Our Long-Term Care Planning Attorneys Can Help You Find a Solution

You’ve worked your whole life to provide for your family and to save for your retirement. You’ve probably tried to plan for you and your spouse or partner to have a lifestyle you can enjoy as you grow older and perhaps, even provide a nest egg or legacy you can pass on to your children or grandchildren. But even the most well thought out plans may not be enough to prepare you for the unexpected costs and nuances associated with long-term care.

Unfortunately, many families think that if they have an estate plan, they have a long term care plan. Nothing could be further from the truth! Download your Free Guide to Long Term Planning to educate your family and begin the conversations about elder law and long term care strategies with the elder law attorneys at Frame and Frame.

How Will You Pay for Long Term Care?

With long term care averaging approximately $9673.00 per month in Maryland, it is important to have a plan for paying for these costs. Medicare does not typically cover the costs for long-term care, so the family’s life savings may have to be spent and that has implications for the healthy spouse or partner, and can impact the children or grandchildren’s inheritance.

Without long term care planning, many families have to utilize a variety of methods to cover the costs associated with long-term care, such as:

- Your monthly income,

- Depleting your savings or retirement accounts,

- Family or friends,

- Public benefits such as Medicaid (if eligible),

- Selling your family home

The Time to Start Long-Term Care Planning is Now

According to the AARP, more than 50% of senior Americans will need some type of long term care. Did you know that there are a variety of legal options that may help you plan for, and afford the care you need, without becoming a burden to your children or depleting the savings you have worked a lifetime to accumulate. Our Maryland long-term care planning attorneys can help you figure out the right solutions for your particular needs.

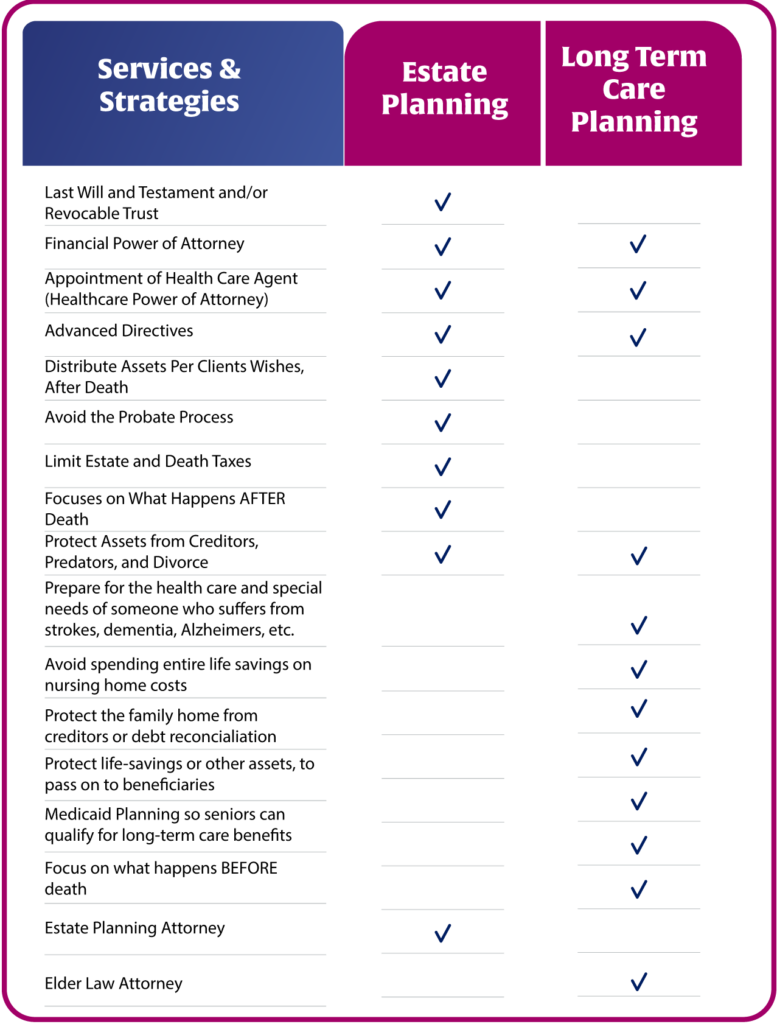

Estate Planning Is Not The Same As Long Term Care Planning

Many families and senior citizens believe that if they have an estate plan, they have effectively done long-term care planning. But, an estate plan only addresses the estate after death. Long-term care planning ensures that the estate (and a person’s life savings) is not completely exhausted by long-term care costs while they are living. That is why it’s important to work

with an estate planning attorney that also specializes in elder law and can take an approach of addressing both needs, at the same time. Both estate planning and long-term care planning

are important, but they address different needs.

In addition, some families may be able to qualify for Medicaid benefits if they have a plan in place, well in advance of any health crisis. Long-term care planning often includes

Medicaid planning – and is provided by an experienced elder law attorney that is educated in long-term care and Medicaid resources and requirements. This is a sub-specialty of estate-planning law and not all estate planning attorneys are familiar with Medicaid law. Long term care planning attorneys will help you plan ahead, in case of incapacity or the need for long-term or nursing home costs.

Planning for Medicaid 5 Year Look-Back

As you can see, long-term care planning and Medicaid planning, in particular, require foresight because, in order to qualify for Medicaid, your entire financial situation will be evaluated with a Medicaid five year lookback requirement. This can have important implications on the parent or senior, as well as their children and, on your overall estate plan. In order to qualify for Medicaid benefits, you will need to understand Medicaid’s resource limits, sometimes called the “asset test.” We discuss this in further detail, in our Free Guide, but in short, many families will need to restructure their financial situation carefully to qualify for Medicaid benefits. If pre-planning is done ahead of time (typically 5 years prior to any requirement for services), you have a much better chance of:

- Qualifying for Medicaid services,

- Providing a trust for the spouse to utilize to continue their lifestyle,

- Preserve family assets and inheritance.

There are ways to do this that can allow you to protect some of your assets for your spouse or partner, as well as for your children and other loved ones. However, if you do nothing, you may not be able to protect some of your assets, and worse, you could be penalized if you transfer assets in a manner that is not allowed under Medicaid rules and potentially risk your entire life savings. This is why Medicaid planning is just as important for the senior as it is for the family.

Hold on to Your Money with Capital Preservation Strategies

For many people, adequate long-term health care, including assisted living or skilled nursing care, is simply not affordable without government assistance. Although Medicare does not cover long term care, Medicaid does. Estate planning is far different than Long Term or Medicaid Planning. Frame & Frame can help you qualify for Medicaid assistance without exhausting your assets before you become Medicaid-eligible.

It is important to have the assistance of knowledgeable, experienced, Maryland elder law attorneys for this process, as not all strategies for spending down your resources will help you qualify for Medicaid. For instance, transferring the title to your home or other assets to another family member could be subject to Medicaid’s five-year “look back” period. Not only could such a transfer not help your situation, but it could be detrimental and cause you to incur penalties as well. Instead, our long-term care planning attorneys will explore options with you, such as trusts or annuities, that are appropriate and allowable methods to protect and transfer wealth without affecting Medicaid eligibility.

Consider Long-Term Care Insurance by the Age of 55

Long term care insurance can be an excellent tool as part of your overall strategy. The younger and healthier you are when you purchase insurance, the more affordable your premiums will be. Your payout may also grow over time, so the sooner you decide to make the purchase, the better. However, long-term care insurance is not for everybody. There are many factors that go into the decision of whether to purchase long-term care insurance, and if so, how much to buy. As part of the overall estate planning we prepare with you, we will make sure you understand long-term care insurance and the role it may play in your long-term care planning.

Our Maryland Long-Term Care Planning Attorneys Will Help You Solve the Problem of Long-Term Care Affordability

Thinking about the need for long-term care may be uncomfortable. Thinking about how you are going to pay for it can be downright unnerving. Fortunately, these issues can be addressed in ways that give security and peace of mind for your future and the future of those you love. At Frame & Frame, our skilled knowledgeable long-term health care planning attorneys can help you evaluate options and prepare for your future care with the right set of tools and legal instruments. Contact us to start the conversation or to schedule a private constulation.